In an increasingly interconnected world wide economic system, companies running in the center East and Africa (MEA) deal with a various spectrum of credit score threats—from volatile commodity selling prices to evolving regulatory landscapes. For monetary institutions and corporate treasuries alike, sturdy credit history threat management is not simply an operational requirement; It's really a strategic differentiator. By harnessing accurate, timely info, your world wide risk administration team can change uncertainty into prospect, guaranteeing the resilient advancement of the companies you guidance.

one. Navigate Regional Complexities with Confidence

The MEA location is characterised by its economic heterogeneity: oil-driven Gulf economies, resource-rich frontier marketplaces, and promptly urbanizing hubs across North and Sub-Saharan Africa. Each individual sector provides its possess credit score profile, legal framework, and forex dynamics. Knowledge-driven credit history chance platforms consolidate and normalize data—from sovereign ratings and macroeconomic indicators to individual borrower financials—enabling you to definitely:

Benchmark threat throughout jurisdictions with standardized scoring types

Recognize early warning alerts by tracking shifts in commodity price ranges, FX volatility, or political hazard indices

Enrich transparency in cross-border lending decisions

2. Make Educated Decisions as a result of Predictive Analytics

As an alternative to reacting to adverse occasions, main institutions are leveraging predictive analytics to anticipate borrower strain. By implementing machine Mastering algorithms to historic and true-time data, it is possible to:

Forecast chance of default (PD) for company and sovereign borrowers

Estimate publicity at default (EAD) under distinct economic situations

Simulate reduction-supplied-default (LGD) using recovery prices from past defaults in equivalent sectors

These insights empower your crew to proactively change credit rating boundaries, pricing procedures, and collateral requirements—driving much better danger-reward outcomes.

three. Enhance Portfolio Functionality and Money Efficiency

Accurate data permits granular segmentation of the credit score portfolio by business, location, and borrower dimensions. This segmentation supports:

Chance-adjusted pricing: Tailor desire costs and fees to the precise chance profile of each counterparty

Concentration checking: Limit overexposure to any one sector (e.g., Vitality, construction) or state

Money allocation: Deploy financial capital extra proficiently, decreasing the price of regulatory cash beneath Basel III/IV frameworks

By consistently rebalancing your portfolio with knowledge-pushed insights, you'll be able to make improvements to return on threat-weighted property (RORWA) and free up money for progress opportunities.

4. Bolster Compliance and Regulatory Reporting

Regulators over the MEA location are increasingly aligned with worldwide criteria—demanding arduous worry tests, scenario analysis, and transparent reporting. A centralized information platform:

Automates regulatory workflows, from information collection to report technology

Ensures auditability, with full information lineage and alter-administration controls

Facilitates peer benchmarking, comparing your institution’s metrics against regional averages

This minimizes the risk of non-compliance penalties and boosts your name with both equally regulators and traders.

five. Greatly enhance Collaboration Throughout Your Worldwide Danger Team

Which has a unified, data-pushed credit rating danger administration technique, stakeholders—from front-Workplace relationship supervisors to credit committees and senior executives—attain:

True-time visibility into evolving credit exposures

Collaborative dashboards that spotlight portfolio concentrations and worry-examination results

Workflow integration with other possibility functions (market place risk, liquidity chance) for a Credit Risk Management holistic business possibility view

This shared “single source of real truth” eradicates silos, accelerates selection-building, and fosters accountability at every level.

6. Mitigate Emerging and ESG-Connected Pitfalls

Further than traditional economic metrics, present day credit rating possibility frameworks integrate environmental, social, and governance (ESG) variables—very important inside of a location wherever sustainability initiatives are getting momentum. Knowledge-driven tools can:

Rating borrowers on carbon intensity and social effect

Model changeover pitfalls for industries exposed to shifting regulatory or consumer pressures

Aid environmentally friendly financing by quantifying eligibility for sustainability-joined loans

By embedding ESG information into credit history assessments, you not merely potential-evidence your portfolio and also align with world wide investor expectations.

Summary

Inside the dynamic landscapes of the center East and Africa, mastering credit score hazard management calls for greater than instinct—it requires demanding, details-driven methodologies. By leveraging correct, comprehensive knowledge and advanced analytics, your world wide risk management crew will make well-informed choices, enhance funds utilization, and navigate regional complexities with confidence. Embrace this strategy currently, and transform credit hazard from the hurdle right into a competitive benefit.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Julia Stiles Then & Now!

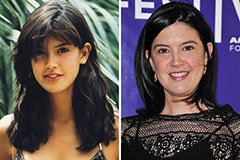

Julia Stiles Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!